Read our blogs on buying or selling a business. There are some handy tips on pricing, things to look out for and more

It's difficult enough to keep track of your own finances, let alone your superannuation. Self-managed super funds are a tricky business, with legislation constantly changing it's difficult to keep on top of it all. But with the help of a professional, you can be sure that your super is working hard for you.

The arm's length principle is used to determine the fairness of related party transactions. This principle states that parties should transact at a fair, market price, with both parties enjoying equal bargaining positions to reach an agreement. This ensures that neither party is subject to the other's control or dominance.

Related party transactions all members of your fund as well as associates of those members. Almost every transaction between your business and your SMSF would be regarded as a related party transaction.

SMSFs must transact at arm’s length, ensuring that no member of your fund receives any present-day benefit. By leveraging an arm’s length transaction between your business and your SMSF, you can tap your SMSF to finance your business growth.

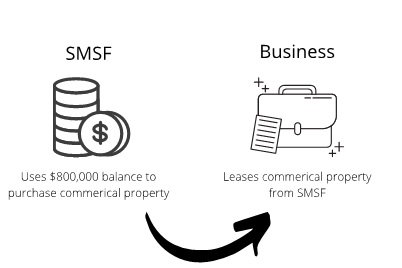

Example: Your business is interested in acquiring a commercial property for $800,000.

Your SMSF can use its balance to purchase the commercial property, in turn leasing the commercial property at a market rate. By offering the lease at a market rate an arm’s length transaction between related parties is established.

By leveraging your SMSF you can avoid the hassle of working with banks or other external parties to obtain a loan,

enabling you to supercharge your business growth whilst creating a lucrative investment opportunity for your

SMSF.

SMSFs offer small business owners significant wealth diversification, ensuring support into retirement regardless of the state of their small business.

Almost all superfund contributions, including those to a SMSF, are taxed at 15%. For instance, if you make a voluntary contribution of $10,000 to your SMSF, you can expect to pay $1,500. Simple? Not so quick.

As your SMSF grows your earnings will usually be taxed at 15%. Your earnings could include:

However, if you’re looking to make the most of your SMSF’s tax benefits, consider leveraging accumulated capital losses.

For instance, if you lost $2,500 on your TSL shares last financial year, you can use your $2,500 to offset your $5,000 gain this year. This reduces your taxable gain to $2,500, reducing your tax payable to $375 (from an original tax payable sum of $750 without accumulated capital losses).

Slash your tax bill even further by making use of fully franked dividends.

For instance, let’s say you receive a fully franked dividend payout of $1,000 from your CBA shares. The fully franked nature of the distribution ensures that CBA has already paid tax on the $1,000 payout.

Assuming a corporate tax rate of 30%, the $1,000 payout would be grossed up sum would amount to $1428.57 ($428.57 of which is tax already paid). The ATO would then charge a 15% tax rate on the sum of $1428.57, amounting to $214.28.

As $428.57 in tax has already been paid, the ATO will supplement your dividend payout with a tax refund amounting to $214.29.

Effectively, by purchasing shares that offer fully franked dividends, you can amplify your dividend payouts.

Artur Osadchiy is the managing partner of Tax Window, a boutique taxation and accounting practise.

May 5th, 2017|Selling a business

Selling a business is different to selling almost anything else, and can be mentally and emotionally demanding. Before you get started, it’s important to understand your business from a buyers’ perspective. This means clearly identifying why your business is for sale, showcasing why it’s worth the price tag, and covering any possible risk factors or areas of concern that a potential buyer would have.

Eddie Pampalian

To learn more about the obstacles business sellers face and what they need to think about, we reached out to Eddie Pampalian, General Manager at Network Infinity Business Brokers, who has been in the business-for-sale market for many years.

According to Eddie, you really need to consider the features of your business before you advertise it. Talking to close friends, others who have successfully sold their business or possibly even an experienced business broker can help you identify what buyers are looking for, and the positives and negatives about your particular opportunity. It’s important to highlight the good, while also outlining and alleviating any possible concerns buyers may have.

Keep reading for our top tips to discover how to prepare your business for sale…

Get your paperwork in order

In decades past keeping a clear and concise paper trail of a business’s financial performance wasn’t as easy, or important as it is today. There was a lot of cash that was used to buy and sell stock, and invoices would get lost along the way, making it hard to run P&L reports or verify figures.

These days, however, with more advanced POS systems, financial software programs and more and more people using the services of bookkeepers, there should be no reason why you can’t provide the right financial information to potential buyers, that helps them verify your claims.

Get your paperwork in order before you start advertising your business, so you have all the required information ready when potential buyers get in touch.

Take a look at your lease

For many small businesses, their location is essential to their success and performance, and can equate to a substantial portion of the business’s goodwill.

If you’re thinking about, or you are ready to sell your business, it’s worth taking a look at your lease. You want to ensure that when you put your business on the market, you’re offering the buyer a lease with reasonable tenure. This will provide interested buyers with the confidence they need to make the decision to purchase. Selling a business that relies on its location without a secure lease won’t be appealing to buyers, and won’t help you get the best price for your business.

Be realistic with the price

Pricing a business for sale can be difficult, especially for those who have never sold a business before. There are many things to take into account that all contribute to the final asking price – but what is actually of value to potential buyers, not just the existing owner, can be difficult to determine.

It’s not uncommon for sellers to want to start advertising their business at a much higher price – with the assumption that buyers will negotiate the price down. However, haphazardly promoting your business with an unrealistic price tag can affect your sale in the long run (often drawing out the process and increasing the time it takes to sell). Ask yourself – if there were two identical businesses, but one was priced much higher than the other, which would you invest your time in?

Before you settle on a price, make sure you do your research on similar businesses in your area, and see what is happening in the business-for-sale market. Engaging an experienced broker, lawyer or accountant can also help you protect your interests, and maximise value to determine the best price for your business.

Showcase the value

At the end of the day, it’s really all about demonstrating the value you’ve built into your business. People want a solid investment, strong ROI and to feel like they’re buying well. There will always be more buyers interested in a business that they perceive offers them more for their money. So, as the seller, it’s your job to highlight the attractiveness of your business and illustrate the value for any potential new owners.

Business agents are bound by regulations set upon them by the governing bodies in the state or territory they are licensed to operate in.

An agency agreement must be executed before a business can be advertised for sale by an agent.

Agency agreements also act as a protection mechanism for all parties by clearly stating what the agents role is, any fees being agreed to and when they are payable, they also cover other items such as when an agent can provide an inspection of the business and cover privacy policies.

Open or Multi agent agreement.

This agreement is used when there are more than one agency acting on behalf of the vendor to sell their business or when the vendor is also trying to sell the business themselves.

In some states these agreements have only a start date whereas others have a start and end date, or they may have a duration period.

There are both advantages and disadvantages to granting your agent this type of agreement, the advantages can be that if your agent is not performing you can offer the business to other agencies to sell it without having the risk of being liable to both agencies success fees.

The other potential advantage is you can find a buyer yourself and again you are not liable to pay a commission.

Disadvantages:

Most agents pride themselves on doing their job to the best of their abilities, however when they are not given any kind of commitment from a vendor or are placed in an auction type environment their ability to provide the right services are compromised for many reasons.

Agents also must limit the amount of time and advertising costs on listings with these agreements as they do not have any window of opportunity in which to capitalise on their investments.

Exclusive / Sole agency agreement.

You normally get the best result when engaging an agent under these types of agreements.

The agents know they have a period in which they must sell to guarantee them payment and therefore you find they will be able to allocate more time and funding towards marketing campaigns designed to get your business in front of the right audience.

It also puts just enough pressure on the agent to act hard and fast whilst providing them with the confidence they need in their client.

In order to get the best results when selling a business, it is essential for the agent to know your business and have all relevant information a buyer is seeking available to them.

Every business is different and will require different types of documentation for presenting to a potential buyer during the due diligence process.

Our agents will spend time with you to learn the essentials about your business and your role within the day to day operations.

Before the agent leaves, they will leave you with a check list of the required documentation necessary, in order to present your business in the best possible manner and with maximum impact.

We believe the more information we can provide a buyer, the better the offers you receive will be. This does not only translate into higher selling prices, but in many instances it can also provide the buyer a platform in which they can make a purchase that results in a simpler process with better terms for both parties involved.

Our agents have the experience, training and support needed to provide you with a superior service.

So, you’ve come to the decision that it is now time to be selling your business. Perhaps you’ve arrived at this decision as part of an exit strategy that you always had planned, or maybe you need to sell your organisation due to an emergency.

Whatever your reason, maybe it is important to be prepared and have as much information on hand as possible.

It is always helpful to know what your business is worth in the current marketplace.

Many people think that it’s a numbers game and the more people know about the business being on the market, the higher the chance of a successful sale. This is true, but only when you have a business that is sellable – think including paperwork, pricing etc.

As for now, we have put together three important points to consider when choosing to sell.

When is the right time to sell your business?

The timing involved with selling your organisation can have a heavy influence on the sale price.

Should you be needing to sell due to ill health or other emergencies, you may find that buyers may use that as a negotiating tool and offer a lesser price in exchange for a quicker settlement.

Good practice would be to go to market with plenty of time for you to find the right buyer and be able to negotiate on important and useful terms relating to training, trials and smooth transitional periods to the new owner.

Pricing, how much?

Pricing can have an influence on price (yes, really). It may sound funny, but I believe it is true.

My personal opinion is that if you overprice your business, it tends to have a negative effect. You see, most buyers on the market have spent some time researching businesses they are interested in and would know the going rates to a degree.

Imagine your business is worth $100,000 and you go to market at $150,000. Firstly,you are attracting the wrong audience (or at the very least scaring off potential customers that feel they cannot afford your business), and secondly, the buyers who are willing to make an offer would look at the amount you have overpriced have the attitude towards the negotiation the same way.

In the above scenario, let’s say you are over by $50,000. With a true value of $100,000, they will assume you want to negotiate at a higher percentage and therefore may come back to you with an offer lower than the real price by similar percentages, something along the lines of $50-$60,000. However, if you were on the market at $115,000, they may think to themselves that the vendor is being realistic and knows the real value and will therefore be inclined to offer a price closer to the true value.

This, again, is my theory and there are many people who may not agree.

Tangible versus intangible assets

A business with tangible assets that have re-sale value will make the business easier to value and thus, sell. Intangible assets such as customer goodwill, the potential business growth and the ‘talk of the town’ in regards to what people think of the business are tougher to value.

People tend to over value potential. Most buyers will respond by saying, “well it’s not there now and therefore not worth anything to me”. Be careful not to overvalue “potential” not only in dollar value, but also as a selling point, as it may make the buyer wonder why you as the current owner have not taken advantage of it as yet.

Also, when you are going to sell your business, you want to make sure you have documentation that clearly states whether or not you own the assets that are being sold or what finance terms are in place.

We hope you have enjoyed this blog, we kept it short and sweet but we would love to hear from you about your experiences.

Written by Edward Pampalian

From owning his first cafe in North Sydney in the late 90′s he fell in love with fine food (yes, you can tell) and specialty coffee. He has subsequently owned and operated six restaurants and cafes, building them up each time with his sound leadership skills and a work ethic second to none. He he has instilled this passion and knowledge of the industry to the team at Network Infinity.

Connect with Edward: Google+TwitterFacebookLinkedIn

Buying a franchise can be an extremely suitable business model for many potential new business owners, as they may feel the experience that the franchisor and their support structure offers is a safer or less risky way of owning their own business. This can be true in many instances, but it’s still important to do the research on the franchise and ensure the opportunity suits your requirements.

A lot can be said about the pros and cons of owning a franchise.

Most franchises usually come with plenty of benefits such as a reputable brand name, proven systems, buying power and much more.

Some negatives can be that entry costs can sometimes be higher than a standalone business and also there is normally is a franchise fee and royalties to be paid. However, these higher costs expedite any major issues as franchisors are bound to strict guidelines via the Franchise Council of Australia (FCA) in ensuring they’re in line with their code of conduct which is administered by the Australian Competition and Consumer Commission (ACCC). The ACCC holds the authority to investigate complaints made by consumers or franchisees.

Undoubtedly, every potential franchisee has a certain set of ideas that they bring to the search when deciding on their dream franchise. It’s important to choose something that you’re passionate about.

If you’re looking to buy a franchise, we can assume that you have had a desire to work for yourself and be your own boss for quite some time but you may not have the experience or know how to start your business. Franchisors generally offer a formal training period which they combine with their own operating systems to help bring together a package that eliminates a lot of time normally associated with research and on the job training. A tried and tested franchise might be exactly what you’re looking for.

A proven system – hit the ground running

Franchises come with a proven turnkey system that enables you to set up shop on the back of someone else’s mistakes, successes, time and most importantly experience. However, it is also important to make sure that the franchise on offer is in a good location and that your territory isn’t decreased due to another franchisee in close proximity. This proven system means that each franchise has been designed with efficiency and productivity in mind. The old adage ‘Time is Money’ is what franchisors have built their businesses upon.

A business with a proven brand

The brand has been proven and goodwill has been built up for you by existing franchisees. Combined with a business plan and an extensive marketing budget, you can be assured that your Franchisor wants you to succeed. After all, their success is your success.

Marketing is much easier

Power in numbers also goes a long way where marketing is involved as many franchisees contribute towards a marketing budget via their royalty payment, which as a whole is larger than most stand-alone businesses can afford.

Consumer confidence is generally higher when they are familiar with the brand name and they tend to know what they are going to consume/purchase, and this is consistent with the brand as they may have tried it in the past.

Financing a franchise

It some cases, it may be easier to finance a franchise than to borrow money to start your own business or purchase an existing one. This is due to the fact that some banks and financiers will have an in house department that deals with the particular franchise you are wanting to work with. Some banks even have dedicated staff members that specialise in business finance of certain franchises and this can go a long way when trying to start out.

This information is only meant as a guideline and providing a brief overview as to the benefits of buying a franchise. Ensure you’ve done your due diligence of the franchise in question before making any major decisions on the matter.

Business brokers are trained professionals who assist individuals in buying and selling businesses.

They will consider many elements when evaluating a business such as location, competition, customers, figures and much more.

A business agent can provide a potential buyer with more valuable information than a licensed valuer. This is due to their experience in the business brokerage industry. Commercial agents converse with potential buyers daily, whereas valuers have the sole responsibility of telling you the businesses worth.

Why should I hire a business broker?

Commercial agents should possess all the skills necessary to be of value to you. Additionally, the agent has to overcome any hurdles along the way by utilising their expertise and experience.

Businesses for sale, specifically small business, rely on the expertise of an agent. The most excellent way for a broker to apprehend this information is through their relationships with buyers and relevant historical sales.

Benefits include:

Starting any kind of business can be one of the most trying things you can ever commit to. This is because you want a business that's considerably tested before. If this is the case, then buying an online marketplace business might just be the right thing for you.

Fortunately, you won't have to look for the most established or the most profitable online marketplace businesses. If you did, the amount of cash that's going to be involved might discourage you.

Instead, look for the following things in the marketplace business:

When going this route, nothing can beat thorough research. Look at everything you're able to look at. Listings will probably give you a description of what the business does, its revenues in the preceding year, and an asking price. If you want to negotiate this price, you may contact the seller through the same listing's contact methods.

But before you get to that, now is the time to dig deep into your potential line of business. Does the niche look sustainable? Will the market still respond to your products and services in the next few years? At this point, figure out how sustainable you want the business to be. Do you want to buy the hottest thing on the block right now and have no problem if it should be completely unprofitable in a specified amount of time? Or, are you looking for some steady and long-term sustainable niche that’ll grow through the years?

All of these questions will help you know which kind of business to pay attention to as you scroll through marketplace listings. If a particular business already tickles your fancy, and you think it has what it takes to be the business you’re planning to buy, slow your roll still and look at more things.

Is there any physical inventory involved? If yes, is there enough support in the potential handover process to give you as much capacity to stock up on this inventory as the current owner currently enjoys?

You should also consider how you’ll get your products to your customers. If your seller doesn’t have this covered, you shouldn’t abort the purchase because of it. If it’s a good business, you can just look up good and reliable packaging companies, such as Stanley Packaging.

You want to be sure your goods will be handled with the utmost care and will arrive at their intended destination in perfect condition. Check if the packaging company you intend to engage uses bubble wrap to ensure the safe transit of their customer’s goods.

At this point, it might be good to ask for the suppliers’ list. It's one of the first and best things you should ensure when acquiring the business.

Can you get the business' email list? Now that you’re sure you can get the right supplies for your business, it could be a good time to consider who exactly you’re going to be selling to.

The revenue numbers you just saw on the listing are a product of a certain operating environment, and it's to your best advantage to make sure you can get both the business and the environment that allowed it to blossom.

You will, of course, need to further perfect your market segmentation and lead acquisition to get an even better mailing list. However, in the meantime, get the mailing list that's there. This will save you the trouble of shooting in the dark from the get-go!

Part of what keeps the marketplace business you’re thinking of buying running is its branding material, and you need to make sure the asking price includes this. Getting everything else without getting the parts of the business that has its name on it can be retrogressive. You opted not to start a new store, yet if you skip this, you just might be!

Clients want to go to the same old social media accounts and domain to see the logos and branding assets they had already gotten used to. As you buy the business, you need to make sure you get its credibility and trustworthiness. It's one of the things pushing its current sales. So, the seller should ideally have all this prepared and ready for handover to you.

Conclusion

Buying an online marketplace business can be a daunting process. But you can cut the rough edges away from it if you pay attention to the right things before and during the transaction.

If things look too good to be true, it might be time to sit down and relook at each pointer given in this article with even greater detail. At the end of the day, after looking at the entire process, you should still be convinced you are making the right decision buying the business.

The best of luck in this potentially rewarding journey!

Copyright © 2025 - NetworkInfinity | Developed by WME